File IRS 2290 Form Online for the Tax Period 2023-2024 & Receive Your Schedule 1 in Minutes

Pricing Starts at $14.90

Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

What Is IRS 2290 Form?

IRS 2290 form is the heavy vehicle use tax (HVUT) truckers are required to file in order to stay on the road. The easy choice is to E-file IRS Form 2290 and save yourself a lot of time. When you E-file IRS Form 2290 with Our Service Provider, you’ll receive your Stamped Schedule 1 by email within minutes of filing.

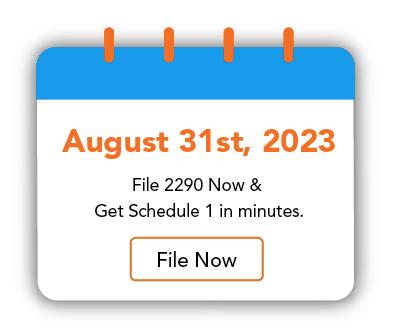

IRS 2290 Form Due Date

August 31 is a major IRS Form 2290 deadline because most drivers use their vehicles in July , so the tax year runs from July 1 to June 30 of the following tax year. However, your form must be filed by the last day of the month following the first month you used the vehicle. For example, if you first use your vehicle in September, then you need to e-file IRS Form 2290 by October 31.

We make it easy to file by the deadline. Simply refer to our easy IRS Form 2290 instructions to file online and instantly receive your stamped Schedule 1.

Note: If any Form 2290 due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Form 2290 is due by August 31st, 2023 for

2023-24 Tax Year.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to know more about IRS 2290 Form Due Date.

IRS 2290 Form Filing Features

Get Your Form 2290

Schedule 1

Use our IRS 2290 Form instructions to e-file Form 2290 and receive your Stamped Schedule 1 via email!

Guaranteed Schedule 1 or Money Back

You will receive Guaranteed Schedule 1 from IRS on your return or your money

Bulk Upload

By using Bulk Upload Feature, You can increase the speed of e-file Form 2290 process by uploading all of your information at once instead of one at a time.

Instant Error Check

Before you transmit Form 2290 to the IRS, we will scan it to catch any basic errors and lower the chance of your form getting rejected.

Free VIN Correction

Free VIN Correction Features enables to change your VIN number, If you have filed with wrong VIN number and helps to get the Schedule 1 with the

corrected VIN

Retransmit Rejected Returns for Free

We help you in correcting the errors, if your Form has been rejected by the IRS. We will Retransmit the rejected returns

Steps To E-File IRS 2290 Form

The Following are the Steps to E-file IRS 2290 Form